About

About Greenwood Roche

Two pivotal areas define the way we’ve shaped our firm to deliver more to our clients:

- Clearly defined specialist areas, each with a significant depth of focused, legal expertise.

- The acknowledgement of a trusted place at a client’s table, where we deliver the high levels of care, rigour and performance our clients expect of themselves.

We don’t stand apart. When briefed by a client we become an embedded part of the team. We engage our depth of knowledge and commercial acumen to swiftly identify what’s required from the outset – and set about delivering it. It’s not a revelatory approach, but it is refreshing, competitive and deeply efficient – and enjoyable.

It has earned us a market reputation as a leader in our areas of expertise where we have established:

A substantial public and private sector client base.

Regular appointments to nationally significant projects.

“They operate with a level of charisma in the room – certainly not order takers. They sense the gaps then find the solutions.”

National coverage

To ensure our specialists are always where they’re needed, we operate as one firm with hubs in Auckland, Wellington and Christchurch. We advise on a range of public and private sector projects.

Specialist expertise

Recent Projects

Recent Projects

McDonald’s Restaurants (NZ) Limited – Resource consent for drive-through restaurant in Ōrākei granted

The Greenwood Roche resource management team, led by Partner Francelle Lupis, successfully obtained consent for McDonald’s Restaurants (NZ) Limited to construct and operate a drive-through restaurant on Kepa Road, Ōrākei, Auckland.

Resource consent has been granted for a 24/7 drive-through restaurant at 152 Kepa Road, Ōrākei, following a publicly notified application and public hearing. The site is located in the Business – Mixed Use zone under the Auckland Unitary Plan and the proposal received over 300 submissions raising a variety of matters.

The reporting team on behalf of Auckland Council recommended that the application be declined primarily due to potential effects on the transport network. The application was nevertheless granted by an Independent Hearings Panel who found the effects of the proposal in this location to be acceptable subject to consent conditions.

Specialist expertise

Key lawyers involved

Close window

Recent Projects

TAG Oil – Sale of NZ Petroleum Royalty Interests

We recently acted for Canadian-listed oil and gas E&P company TAG Oil Limited on the sale of its royalty rights to the onshore Taranaki petroleum assets it sold to Matahio Energy Limited.

The sale of the royalty rights, in the nature of deferred consideration, followed the original 2019 sale transaction, on which we also acted. The New Zealand assets of TAG Oil included PMP 38156 (Cheal and Cardiff), PMP 60219 (Cheal East), PMP 53803 (Sidewinder), PMP 60454 (Supplejack), and PEP 51153 (Puka).

Part of the royalty sale consideration is contingent on cumulative production from the permits exceeding 1 million barrels of oil equivalent within certain timeframes. The transaction allows TAG Oil to reallocate resources to advance its core business operations, now focusing on Egypt.

Specialist expertise

Key lawyers involved

Close window

Recent Projects

Tōtara Energy Limited Partnership: Equity Investment in Pioneer Energy Group

Greenwood Roche recently provided independent advice to a group of minority iwi shareholders, led by Tupu Angitu, in relation to their investment in the Tōtara Energy Limited Partnership.

The Tōtara Energy LP, led by cornerstone investor Tauhara North No. 2 Trust, is to acquire a 30% share in a Pioneer Energy Group LP structure, supporting further investment in renewable and waste-to-energy projects alongside Central Lakes Trust.

Specialist expertise

Key lawyers involved

Close window

Recent Projects

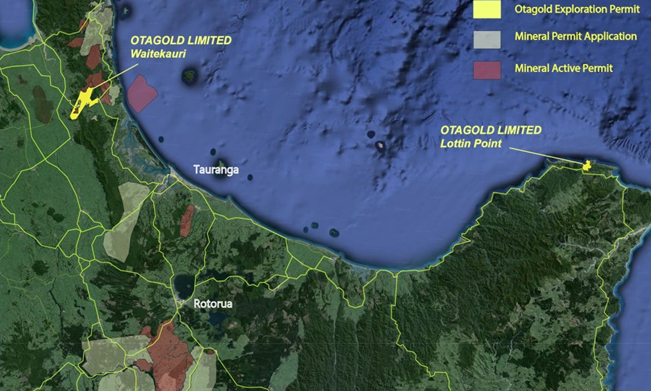

Uvre Limited – NZ Gold Projects

Corporate and energy partner Brigid McArthur recently acted for Perth-based uranium and lithium explorer Uvre in obtaining necessary regulatory approvals for its acquisition of four New Zealand gold projects held by Otagold Limited.

Otagold’s flagship project is MEP 61021 (Waitekauri), located in the Hauraki goldfield near Waihi. The project is believed to have excellent resource potential.

The acquisition covers also the Lottin Point Gold Project in the North Island (first discovered by Anglo American) and the Roaring Meg, Oturehua, and Invincible gold projects in the South Island. The acquisition is symptomatic of the recent increase in interest in minerals and petroleum projects, associated with a change of government policies and changes to the Crown Minerals Act 1991.

Specialist expertise

Key lawyers involved

Close window

Recent Projects

Foundation Village – Pearson Residences – Fast Track Consent Granted

The Greenwood Roche resource management team, led by Partner Francelle Lupis, has assisted Generus Living Group to obtain fast-track consent under the COVID-19 Recovery (Fast-track Consenting) Act 2020 for the construction of the 13-storey Pearson Residences building in Parnell, Auckland.

The Pearson Residences building is the third and final stage of The Foundation, a $500 million retirement village in central Auckland, designed by Peddlethorp architects and officially opened by the Prime Minister in March this year.

Pearson Residences is located in the centre of the Foundation precinct, surrounded by Foundation Building 1 and Building 2, Birthcare, Pearson House, ACG Parnell College, the Jubilee Hall and Foundation on George Street building. The resource consent authorises the construction of the 48m central building, containing 65 retirement units and care facilities, a range of resident amenities, two levels of basement carparking, landscaping and a pedestrian airbridge connecting to Building 2.

Specialist expertise

Key lawyers involved

Close window

Recent Projects

New Tiwai Electricity Contracts

Brigid McArthur has recently completed for Rio Tinto and New Zealand Aluminium Smelters a suite of new 20-year electricity contracts, including ground-breaking demand response contracts.

The new deal ensures the Tiwai Point aluminium smelter remains open after years of uncertainty around its future, a massive relief for employees, Southland and Tiwai’s many stakeholders.

This uncertainty has long unsettled NZ energy markets and deterred investment in new renewable generation.

The overall deal replaces NZAS’ previous Electricity Agreement with Meridian Energy, a long‑term contract for differences providing NZAS with hedge cover for up to 572 MW.

Under the new arrangements, hedge cover for up to 572 MW in aggregate is provided by three different generators (Meridian Energy, Contact Energy and Mercury NZ) through a portfolio of different CfDs. The challenge was to ensure the rights and obligations, risks and operational management of the different contracts work alongside each other seamlessly, having regard to the separation between them.

NZAS is the country’s single largest electricity consumer, taking around 13% of NZ’s electricity supply. The new deal also includes separate contracts with Meridian and Contact that enable them to call on NZAS for various different tranches of demand response. In effect, NZAS can be required to dial back production when there is a shortage of power in the grid. The smelter therefore acts as a battery for the NZ electricity system, ensuring the lights are kept on when NZ needs it most.

Specialist expertise

Key lawyers involved

Close window

Recent news & insights

News & Insights

Wellington Property People Awards 2025

Whakamihi to Emily Newmarch of Warren and Mahoney, who took home the highest accolade, the Greenwood Roche Supreme Excellence Award at the 2025 Property Council – Wellington Property People Awards on Friday 14 November at Tākina. Over 380 industry leaders and rising stars came together to recognise and celebrate the changemakers in the Wellington region whose mahi, talent, and passion is shaping a stronger and more sustainable Wellington.

The judges cited Emily’s “extraordinary impact” in translating PhD-level climate research into practical, low-carbon design solutions across sectors ranging from health to aviation. Her influence extends well beyond the studio, with contributions to industry education through the New Zealand Institute of Architects and her international speaking engagements focused on sustainability in design. Emily’s impact was recognised with her being awarded both the Beca Young Achiever Award and the Greenwood Roche Supreme Excellence Award.

Greenwood Roche would like to extend its congratulations to all award recipients and nominees from the evening, with a special mihi to Jim Wana, who took home Catalyst Property Professional of the Year, and to Grant Heighway of Catalyst, who was presented with the Rolle Property Outstanding Leadership Award.

Thank you to the team at the Property Council New Zealand for organising another wonderful night of connection and celebration.

Greenwood Roche looks forward to continuing our association with the Awards in 2026.

Download as a PDF

Close window

News & Insights

Welcome to Zaneta Easter

We are very pleased to announce the addition of Zaneta Easter as a Senior Associate.

We are very pleased to announce the addition of Zaneta Easter as a Senior Associate in the Greenwood Roche team.

Zaneta has broad experience across many facets of commercial property law, including commercial leasing arrangements, subdivision and development, acquisitions, due diligence, disposals and construction. She acts for a range of public and private sector clients, major corporates and developers.

Zaneta is known for her clear, commercially focused advice and pragmatic approach.

Zaneta will be based in our Wellington office. Welcome to Greenwood Roche Zaneta!

Download as a PDF

Close window

News & Insights

Picking up the pace on public works

The Government has moved a step closer to updating the Public Works Act 1981 (PWA) after half a century of little reform. Driven by a goal to remove the current barriers to infrastructure development, Chris Penk, the Minister for Land Information, has recently announced that a Public Works Amendment Bill will be introduced to Parliament in mid-2025.

A Government-appointed panel reviewed the PWA last year and found that there is unnecessary duplication in the current system, issues with outdated negotiation processes and disjointed government agency practices, all of which are contributing towards significant delays in the delivery of public works projects.

The outcome of the PWA review is to make changes to the PWA. The recently-announced changes include the following:

Shifting some of the decision making from LINZ to government agencies

While the Minister for Land Information will retain responsibility for decisions relating to the compulsory acquisition of land by the Crown, government agencies such as the New Zealand Transport Agency will be empowered to enter into voluntary land acquisition agreements with landowners on behalf of the Crown. Currently, Land Information New Zealand (LINZ) has the sole power to enter into agreements for the Crown.

It remains to be seen which government agencies will be granted this power, but we would expect that the government agencies with larger landholding portfolios and active programmes will be considered first.

The change will not affect local authorities, who can already enter into agreements under the PWA for local public works without LINZ approval.

Improved collaboration between government agencies

Where there are connected public projects, the Government seeks to encourage coordination of the acquisition of land.

Under the current PWA, the Government and local authorities can (but rarely do) collaborate on works of combined national and local importance, but agencies are otherwise required to act

separately. The current distinction between national and local works is arbitrary and archaic. We hope the collaboration powers are drafted to include all overlapping public works, regardless of which agencies undertake them, to allow efficiencies to be gained by working together.

Enabling infrastructure relocation

It is proposed to expand the power to acquire land under the PWA to include land required for infrastructure owned by a third party, where that infrastructure needs to be moved to make way for a public work.

This change will address the limitations that were introduced by the Supreme Court in Seaton v Minister for Land Information in 2013, which held that the Crown was unable to acquire an easement from an affected landowner under the PWA when the easement is intended to be transferred to a third party. In that case, easements could not be acquired to allow electricity lines owned by a local lines company to be moved out of the way of a highway-widening project.

The breadth of this change will be interesting. We would like to see easements able to be acquired and provided to other private landowners, not just to infrastructure providers. Acquiring a right of way for the benefit of a private landowner might well be the best solution when their existing access is cut off by a new motorway.

Refining the role of the Environment Court

The Environment Court acts as an independent check on land acquisitions for public works, particularly in considering and making determinations on landowner objections to the compulsory acquisition of land. An objection to the Environment Court can substantially delay a land acquisition.

The Government proposes to refine the role of the Environment Court in this process by clarifying the factors the Court can consider when reviewing objections. Minister Penk has announced that the renewed focus will be on “individual property rights, removing the overlap with the Resource Management Act”; an objective clearly intended to reduce the scope of objections made by landowners under the PWA.

Alternative dispute resolution before the Land Valuation Tribunal

The Government proposes requiring that disputes over compensation are attempted to be resolved through mediation and alternative dispute resolution forums, before a claim is made to the Land Valuation Tribunal. Currently, claims for compensation (if compensation is not already agreed) are filed at the Land Valuation Tribunal at an early stage.

Mediation cannot force the parties to reach agreement and will, in some cases, be a fruitless step. In other cases, however, the less-formal process and setting may encourage agreement on compensation issues.

New powers for Transpower

The Government proposes allowing Transpower, the State-Owned Enterprise managing New Zealand’s national electricity grid, to acquire land by agreement under the PWA.

Currently, if network utility operators – be they privately-owned or owned by the Government – need land for a project, they can apply to the Minister for Land Information under section 186 of the Resource Management Act to acquire land for that project on their behalf. This is a backstop provision, recognising the importance of network utility operations even if privately-owned.

The proposal seems to apply only to Transpower, presumably due to the scale and cost of its projects and its public ownership. It appears the Government’s intention that any compulsory acquisition of land for Transpower would be dealt with by LINZ in the current way.

Next steps

The above discussion addresses just some of the changes proposed. The Government has previously announced changes to the valuation of Māori freehold land when it is acquired for a public work, and to require that any compulsory acquisition of Māori land is approved by two Ministers. Further policy changes may also be announced.

It is too early to take a view on whether the incremental changes announced so far will achieve the Government’s intention of “going for growth”. Further policy announcements and the wording of the draft Public Works Amendment Bill due to be released mid-year will be telling, but so far it seems that there is a real drive for a more efficient PWA regime to improve the timely delivery of large infrastructure projects in New Zealand. For more information on the PWA changes, please contact our public law team.

Download as a PDF

Close window

News & Insights

Offshore Renewable Energy Bill - Overview

Below is an overview of the Offshore Renewable Energy Bill

The Government has this week delivered on its promise to introduce to the House bespoke legislation establishing a permitting regime for offshore renewable energy, continuing work started several years ago to encourage more renewable energy as part of our net carbon zero goals.

The Offshore Renewable Energy Bill is not limited to offshore wind, and could for example enable the development of tidal or other marine energy projects. Offshore wind developers have been working closely with MBIE for several years to help shape a fit for purpose regime for New Zealand.

In a way not dissimilar to how the Crown Minerals Act provides for the petroleum and minerals permitting regime, the Bill will afford exclusivity of tenure to selected developers who have the best prospect of delivering offshore renewable energy developments that will maximise the benefit to New Zealand.

The Bill introduces a permitting regime similar to that of the Australia. The closely aligned regimes have the potential to allow developments in New Zealand to track closely behind those being initiated by developers in Australia, enabling developers to benefit from regional collaboration and supply chain synergies.

The Bill will create:

- a two-stage permitting regime (an initial feasibility permit of up to 7 years’ duration and a subsequent commercial permit), to give technically and financially capable developers time to undertake preliminary feasibility assessments and environmental studies, before moving to a commercial permit of 40 years. Importantly, the grant of a feasibility permit ensures that only that permitholder will be able to apply for the subsequent commercial permit over that area of the seabed;

- consultation requirements including specific requirements for consultation with Māori groups (noting that most developers have been actively engaging with relevant iwi for several years);

- decommissioning and financial security obligations to ensure appropriate decommissioning of offshore renewable energy infrastructure is at the expense of permit holders;

- safety zones of up to 500 metres around offshore renewable energy infrastructure; and

- administration, monitoring and enforcement of the regime and associated offences and penalties.

The Bill is the next step in the Government’s Electrify NZ policy to double renewable energy generation and transition to net-zero carbon emissions by 2050. The Government estimates the Bill will be passed by the middle of 2025 with the first feasibility round initiated by late 2025 and the first feasibility permits granted in 2026.

The Bill does not deal with environmental approvals, which will fall to be dealt with under a mix of the Resource Management Act (as amended), the Continental Shelf and Exclusive Economic Zone (Environmental Effects) Act and the Fast-Track Approvals Bill once enacted. Other marine legislation will also apply depending on the development.

If you are interested in offshore renewable energy developments in New Zealand and need to know more about the Bill and related regulatory and industry issues, please contact:

Brigid McArthur or Geoff White

Download as a PDF

Close window

News & Insights

New TLANZ agreement to lease and deed of lease released – more “plug and play” options but not a “one-size-fits-all” solution

The Law Association of New Zealand Incorporated (TLANZ) has unveiled new versions of its previously ADLS-branded agreement to lease and deed of lease, aimed at providing landlords and tenants with more options and embracing a number of recent commercial leasing trends.

On 25 November 2024, TLANZ (rebranded from the Auckland District Law Society Inc. (ADLS)) released new forms of:

• agreement to lease (Sixth Edition 2024), to replace the existing ADLS form (Fifth Edition 2012 (4)); and

• deed of lease (Seventh Edition 2024), to replace the existing ADLS form (Sixth Edition 2012 (5)).

The new forms (and more particularly the deed of lease) have been significantly updated to reflect industry feedback and current market practice over the last 12 years, while providing more flexibility and still intending to represent a relatively balanced position for use by both landlords and tenants. However, they are still not a “one-size-fits-all” solution, some updates favour one party over the other compared to the existing ADLS forms, and parties will need to consider their position carefully when negotiating leases on the new forms.

So what has changed?

One of the most significant changes is the updating of the first schedule to the lease forms to provide for a number of additional commercial variables. However, parties will need to exercise caution with the “plug and play” approach adopted by TLANZ, and default positions apply if they are not completed.

Key changes/highlights:

• Agreement to lease - The agreement to lease has been updated to incorporate the same changes made to the first schedule of the lease, and it is intended to be used in conjunction with the new lease form. Given the extensive changes to the first schedule to both forms, there is now less flexibility to mix the new forms with the old.

• New options for rent reviews and adjustments – There are now new options for:

o fixed rent adjustments, which have become increasingly popular;

o variable rent collars and rent caps on rent reviews or adjustments (whether market rent or CPI) – including options for a hard ratchet, a soft ratchet, an initial term commencement date ratchet, or any other cap and/or collar variation the parties may agree on; and

o interim rent payments pending completion of market rent reviews.

• Market rent reviews – The market rent review process is now consolidated so it applies to both mid-term reviews and reviews on renewal. This means that market rent reviews on renewal (as well as mid-term reviews):

o can now be initiated any time up to the next review or adjustment date (whether a market review or CPI or fixed rent adjustment date); and

o are subject to the same strict deadlines (now increased to 30 working days) for objecting to any rent proposed by the party initiating the rent review.

• Outgoings – Tenants will welcome a more transparent pass through of outgoings. Several adjustments and clarifications have been made to the outgoings categories in the first schedule but no notable new categories of outgoings have been added. There is a clear obligation on the landlord to provide a budget for outgoings, but the landlord is only required to provide copies of assessments, levies and accounts relating to outgoings incurred if the tenant asks for them to verify and reconcile outgoings. The landlords is now unable to recover outgoings if an estimate or actual amount is notified more than 24 months after an outgoing has been incurred. Management expenses must be reasonable and reasonably incurred.

• Insurance – The default position for loss of rents cover has increased from 12 months to 24 months, which will likely impact the cost of outgoings payable by the tenant. The default sum of the excess has increased from $2,000 to $5,000 plus GST. The lease provides differential treatment for recovery of the excess based on whether the tenant is at fault or not. Where the landlord makes a claim on its policy and the tenant is not at fault, the tenant will be liable for its proportion of the excess as an outgoing (subject to the specified cap). Where the tenant is at fault, it will be liable to pay the excess up to the specified cap. However, despite the parties agreeing a cap, the cap can increase if the excess under the landlord’s policy increases as a result of the tenant’s fault.

• No access in emergency and abatement of rent and outgoings – There is more flexibility for the parties to agree upfront on what is a “fair proportion” of rent and outgoings to abate where the tenant is unable to access the premises due to an emergency. However, the parties need to be aware the default abatement option in such circumstances is 50% of both rent and outgoings, and that 50% may not be fair for all potential scenarios in which inaccessibility may arise. The parties may, within a specified period following any particular emergency that results in inaccessibility (commencing 20 working days after the inaccessibility begins and expiring three months after access is restored), review whether the agreed proportion is in fact a fair proportion in the circumstances – for that particular emergency only. In doing so, the parties must review the relative effect on each party’s position (not just that of the tenant) as a result of the application of the abatement provisions and the tenant’s inability to gain access.

• Security for tenant’s obligations – The lease now includes extensive provisions for tenants to provide bank guarantees and rental bonds either in addition to or instead of personal guarantees.

• Compliance with laws – Reciprocal obligations are included for health and safety, including consultation and coordination and notification of notifiable events, but there is still no reciprocal general requirement for a landlord to comply with all other laws. The landlord no longer has the right to terminate the lease if it considers upgrade or improvement costs that are required by statute or an authority are unreasonable.

• Yielding up, reinstatement, removal and make good – There has been a reorganisation of these provisions, which are now in one clause. However, the fundamental position has not changed – full reinstatement, removal and make good obligations still apply with no option for a lesser obligation.

• Partial or total destruction – A number of changes have been made to these provisions, including that the landlord must spend the insurance money it receives plus an amount equal to the applicable insurance excess in reinstating the premises. Where the lease is terminated under these provisions, the landlord cannot require the tenant to remove its fixtures, fittings and chattels, but if the tenant does do so, it must make good any resulting damage.

• Seismic rating – A seismic clause is now included, but it has no real teeth. There is an option for the parties to record the assessed (rather than required minimum) seismic rating of the building in the first schedule. The provisions assume the landlord has provided the tenant with a report or other information that assesses the seismic rating and include a requirement that the landlord provide any report or other information that the landlord becomes aware of that contains a materially different assessment. However, the landlord does not give any representation or warranty as to seismic rating or performance of the building, and there are no consequences if the building is found to have a different seismic rating. Parties will need to amend the lease as appropriate in the circumstances if they wish to change the operation of these provisions.

• Mortgagee consent – A prudent tenant would amend the previous version of the lease to require a landlord to obtain consent to protect its position against a mortgagee taking possession of the premises. This is now one of the variable options to be completed in the first schedule.

The above are key changes only. There are a number of other changes that also require consideration and comment when using these forms. We can help navigate the changes. Please reach out to one of our team below for advice on how the new lease could impact your leasing transactions either as a landlord or a tenant. Clicking on their name below will take you through to their profile on our website where you will find their contact details.

Download as a PDF

Close window

News & Insights

Residential Development Underwrite

The Ministry of Housing and Urban Development (MHUD) has recently announced a time-limited underwrite initiative aimed at stimulating residential construction activity during the economic recovery.

The Residential Development Underwrite (RDU) is targeted towards developments which:

- can deliver significant housing supply to the market;

- are situated in locations in most need of such supply (i.e. the main urban centres); and

- present a low risk/cost for the Crown.

For successful applicants, the RDU involves the Crown committing to buy a specified number of houses within a residential development for which the developer cannot secure pre-sales, at an agreed discount to the market price. The RDU will, arguably, enable developers to achieve the funding pre-conditions set by their lenders, boosting supply to the market in the next 6 to 12 months.

MHUD is now inviting applications for the RDU. The applicant must:

- be an established residential developer with a proven track record of successfully building and selling houses of a similar size and scale;

- have ownership or use of the land (or an option to do so);

- have all necessary resource consents for the development;

- be able to prove that the underwrite is needed for the development to proceed within 6 to 12 months of the application (for example, reasonable attempts to market the development have been made, finance approval is conditional on securing pre-sales and the developer has procured the contractors for the development); and

- be able to provide a recent market valuation for the development/houses from a registered valuer.

In addition, the development must have a minimum of 30 houses or, if the development is staged, the relevant stage must have a minimum of 30 houses.

Priority will be given to developments which can deliver the most houses (in locations that most need them) for the least risk and cost to the Crown. This means MHUD will favour those developments situated in the main centres (primarily Auckland, Hamilton, Tauranga, Wellington and Christchurch), which have a lower number of houses needing pre-sales underwritten, and a lower underwrite price. Developments which need 100% of pre-sales underwritten will not be accepted. While most developments are likely to be located in the main centres, developments in other locations may be considered where such developments meet the criteria.

There is no price cap on the sale of houses within a development, meaning the RDU is not limited to providing an underwrite for affordable housing only.

Applications will be generally assessed against the following assessment framework:

Risk and net cost to the Crown 35%

Project readiness 25%

Volume and nature of supply 20%

Location 20%

More details in relation to the assessment framework for RDU and the application process can be found on the Ministry of Housing and Urban Development website*. Applications opened on 7 October 2024 and, while MHUD has specifically indicated that the availability of the RDU is time-limited, no final closing date for applications has yet been specified. MHUD has been clear that applications are not being assessed on a “first come, first served” basis and are encouraging applicants to take the time necessary to prepare high quality applications.

*Click on the wording Ministry of Housing and Urban Development website in the article above to follow the link.

Download as a PDF

Close window

Return to top